🔒🪙 Grifted: Sam Bankman-Fried & the FTX Fantasy (Subscribers Only Edition)

🕵️♂️ Grifted: Volume 5 ++

🕵️ Grifted: Success That Survives the Scam

🪙 Grifted: Sam Bankman-Fried & the FTX Fantasy

Hook:

The coin didn’t exist—but the charisma did. Until the math stopped working.

He was the “next Warren Buffett” in cargo shorts—until $8 billion in customer funds disappeared. What looked like the future of finance turned out to be a masterclass in misdirection.

Lessons:

Ponzinomics, platform worship, influencer bait, and the illusion of decentralization.

🎯 Series Theme

True stories of fraud, failure, and financial fantasy—told not just to entertain, but to equip.

In each installment, we unpack how the biggest business betrayals happened—what people believed, what was really going on, and what you can do to avoid becoming the next victim, bystander, or scapegoat.

This series is part corporate true crime, part survival guide for professionals who want to lead, build, and invest without getting conned.

To our brilliant paid subscribers—thank you. This one’s for you: the unfiltered, unglossed breakdown of how Sam Bankman-Fried built a financial mirage and called it innovation. Let’s dig in.

🧠 The Rise 📈– Why People Bought In

It started, as these stories so often do, with a genius no one could quite explain—but everyone agreed was brilliant.

Sam Bankman-Fried was awkward in the kind of way people mistake for exceptional. MIT-educated, frizzy-haired, always hunched over in cargo shorts and running shoes like he’d just stumbled out of a dorm room and onto a TED stage. He played League of Legends during investor calls and still walked away with billions. That wasn’t a red flag—it was a feature. He was "playing the long game," they said. "Unconventional," they said. “A new kind of capitalist who doesn’t care about money,” they said, right before wiring him $200 million.

He didn’t sell himself as a financial genius. He sold himself as a moral one.

Wrapped in the ideological armor of Effective Altruism, SBF promised to earn staggering wealth only to give it all away. He wasn’t hoarding money—he was hoarding potential impact. He wasn’t buying yachts—he was “maximizing utility.” The story landed like scripture in a Silicon Valley desperate for a prophet who could code. It made him bulletproof. It made asking questions feel cynical. After all, he wasn’t in it for the Lambos. He was in it for the lives saved.

The media fell fast and hard. Forbes crowned him the “Next Warren Buffett,” if Buffett had taken shrooms and stopped showering. Bloomberg, Fortune, and the Twitter VC crowd praised his genius with a kind of reverence usually reserved for tech gods and TED talkers. He wasn’t just running a crypto exchange—he was reimagining finance with the wide-eyed confidence of someone who had never been told “no.”

Then came the celebrities.

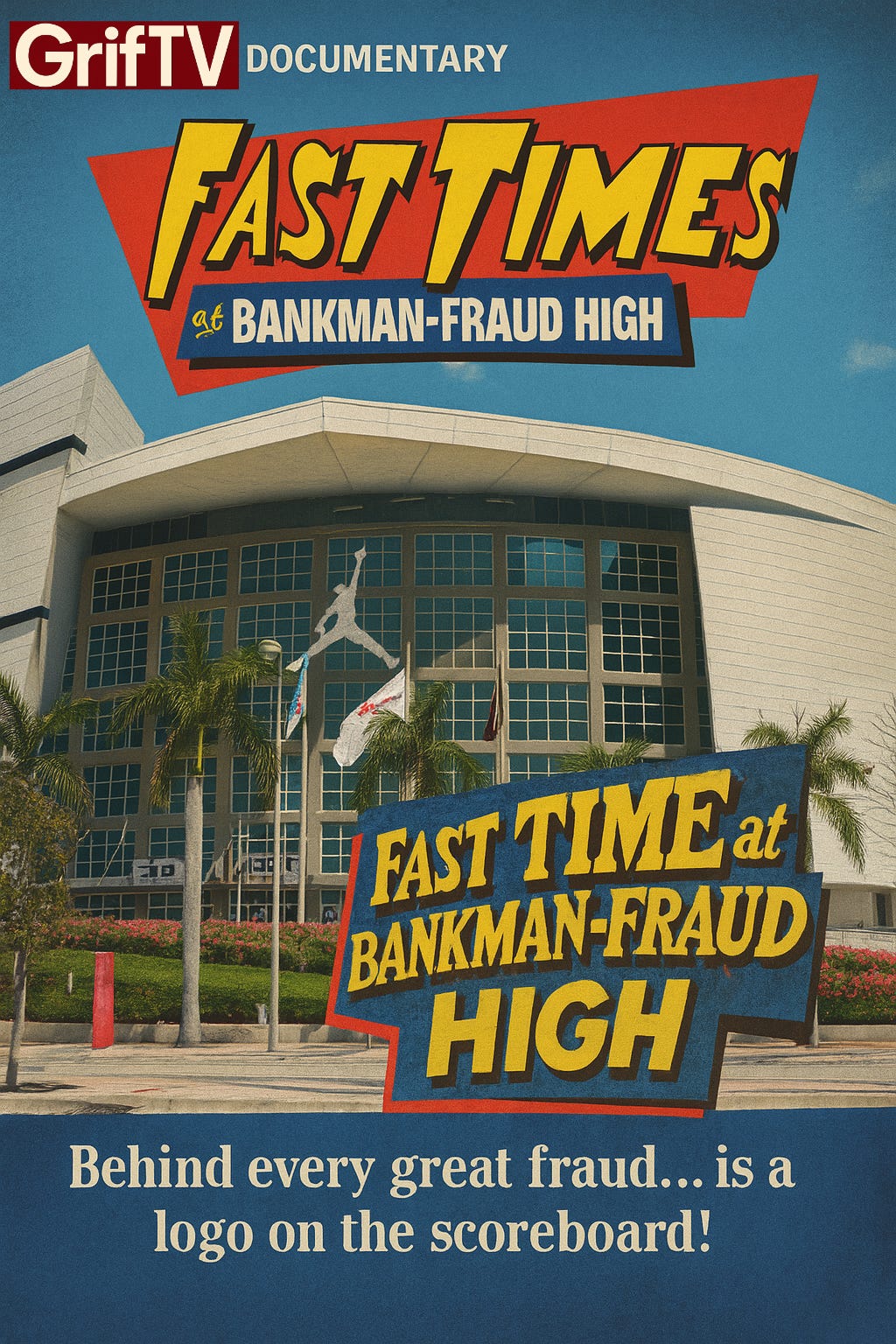

Tom Brady. Steph Curry. Gisele. Larry David. FTX bought naming rights to arenas and flooded the airwaves with endorsement deals. If the future of finance looked like Sam, the commercials said, you better start trusting the algorithm. People didn’t just believe in FTX—they felt late to the party.

And no one—not one high-profile investor, celebrity, or regulator—seemed to care that FTX had no CFO. No real board. No audits. No guardrails.

Just vibes. And spreadsheets. And one soft-spoken kid from Stanford who said, "Trust me."

And they did.

“People weren’t investing in crypto. They were investing in Sam.”

💸 The Lie 🍹 – What Was Actually Happening 🚨

The illusion was elegant. The fraud was not.

Behind the sleek branding and moral posturing, FTX was a shell game—played at high speed and with other people’s money. At the center was Alameda Research, a hedge fund in name only and a piggy bank in practice. SBF had quietly wired the back end of FTX to funnel billions of customer funds into Alameda, where his inner circle used it to make reckless bets, cover losses, and prop up the illusion of genius.

The money moved fast. The accountability didn’t move at all.