🔒💀 Grifted: Lehman Brothers – Collapse So Loud It Shook the World (Subscribers Only Edition)

🕵️♂️ Grifted: Volume 3 ++

Top of the Series: WorldCom — The Telecom Giant That Billed Us for a Fantasy

Previous: Enron — The Energy Empire Everyone Worshipped (Part II)

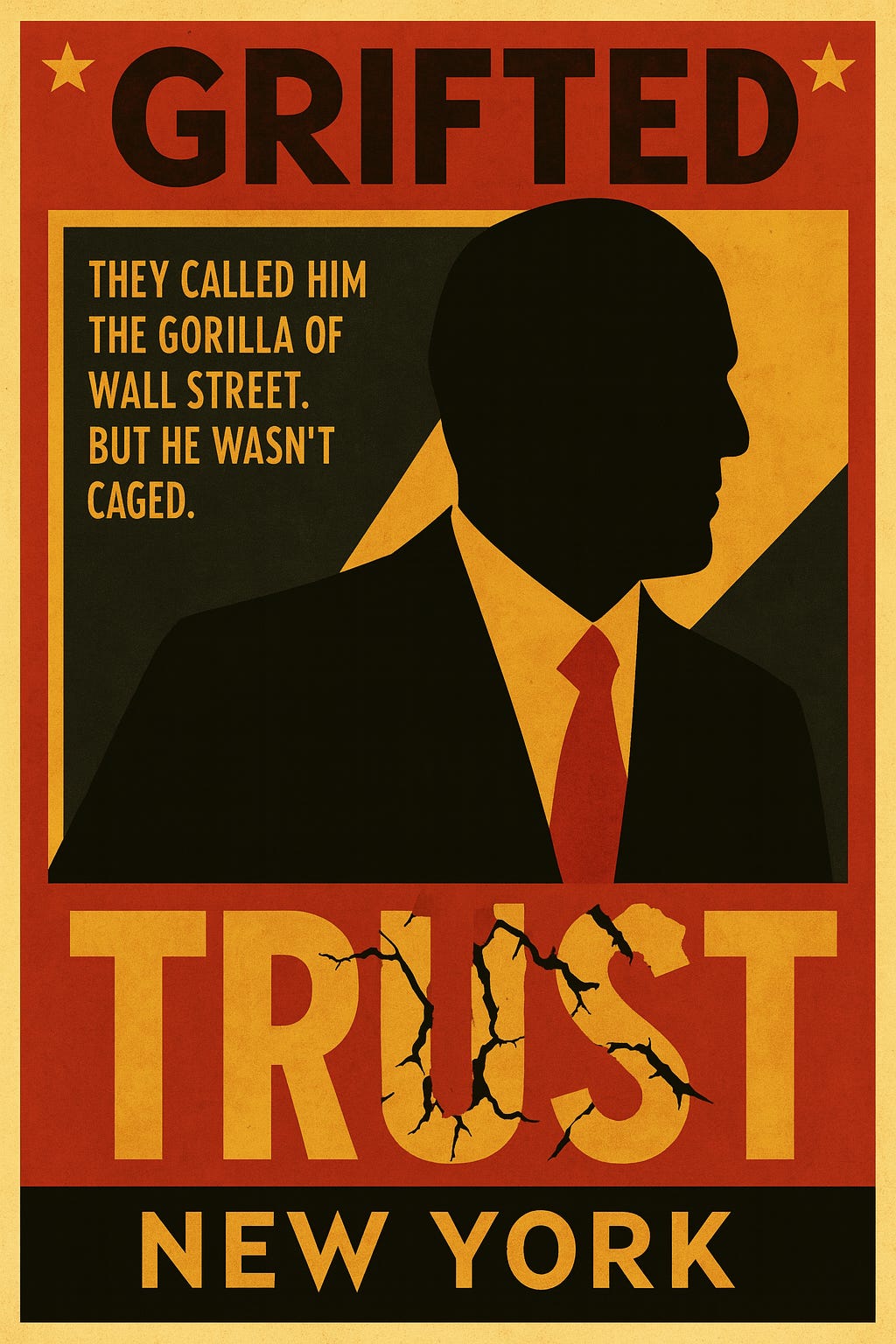

💀 Grifted: Lehman Brothers – Collapse So Loud It Shook the World

Subscriber-Only Edition

✉️ Welcome, Subscriber

You’ve unlocked a story too explosive for the public feed.

While Bear Stearns collapsed in five days, Lehman Brothers took the entire financial system down with it—in one weekend.

This is Grifted: Success That Survives the Scam—a series for those who want to understand not just how power miscalculates, but how denial becomes doctrine at the highest levels of business.

And today’s entry isn’t about a lone conman.

It’s about an institution too old to question, too arrogant to adapt, and too slow to save.

This is Lehman Brothers—the fall that proved no one is untouchable.

🎯 Series Theme

True stories of fraud, failure, and financial fantasy—told not just to entertain, but to equip.

In every Grifted post, we dissect what people believed, what was really happening, and how to avoid becoming the next victim, bystander, or unwitting accomplice.

Part corporate true crime, part survival guide for professionals who want to lead, build, and invest without getting conned.

👉 You’re in the vault now.

Let’s open the books.

💼 The Rise – The Gods of Wall Street

For decades, Lehman Brothers was synonymous with prestige, power, and pure financial muscle. Founded in 1850, it survived the Civil War, two World Wars, the Great Depression, and the dot-com bust. It was more than a bank—it was a legacy institution, with a storied name and marble-lobby swagger that screamed “We are the market.”

From Cotton to Collapse

Lehman Brothers began not on Wall Street, but in Montgomery, Alabama, in 1850—founded by German immigrant brothers Henry, Emanuel, and Mayer Lehman. Originally a dry goods store, the firm quickly pivoted to cotton factoring, financing the backbone of the Southern economy. When Henry died in 1855, the two surviving brothers expanded the company’s reach into commodities and trade. Despite the economic turmoil of the Civil War, Lehman leveraged its growing financial savvy to position itself as a player in the Reconstruction South—quietly evolving from merchant to money mover. It wasn’t born a titan. It became one by adapting faster than the chaos around it.

By the early 20th century, Lehman had migrated to New York and embedded itself in the machinery of American capitalism. It helped underwrite everything from department stores to airlines. As the Great Depression gutted the market, Lehman was battered—but not broken. Unlike flashier rivals that collapsed overnight, Lehman’s conservative strategies and institutional discipline kept it afloat. When World War II reshaped the global economy, Lehman was there to finance the postwar boom. As the decades rolled forward, it transformed again—less family-run merchant bank, more Wall Street powerhouse. It learned how to dress like Morgan Stanley, move like Goldman Sachs, and sell risk with the confidence of a seasoned politician.

By the late 1990s and early 2000s, Lehman wasn’t just part of the financial establishment—it was the establishment. It had weathered every market shock America had endured: the ’87 crash, the S&L crisis, even the dot-com bust. The firm seemed unkillable, an institution built not just on capital but on narrative—resilience, prestige, and grit. Its midtown headquarters gleamed with polished floors and unspoken certainty. Employees walked with the quiet arrogance of survivors, of those who had seen the storms come and go and were still standing. Lehman didn’t just do business—it wrote its own myth in marble and legacy. That myth, like many empires before it, was built just high enough to fall spectacularly.

Under CEO Dick Fuld, Lehman wasn’t just riding the wave of global finance—it was trying to own the ocean. Aggressive, unapologetic, and addicted to expansion, Lehman dove headfirst into the real estate boom with one hand on the mortgage pipeline and the other on the throttle of securitization. Fuld wasn’t shy about his ambition—he wanted to be bigger than Goldman Sachs. In his mind, he already was.

Investors believed. Analysts applauded. Politicians smiled. The media praised Lehman’s “savvy leadership” and “growth mindset.” Everyone was buying what Lehman was selling.

Until the product—and the pitch—turned to poison.

🧨 The Lie – Solvent on Paper. Rotting Inside.

Lehman wasn’t just leveraged. It was financially overclocked.

Behind the rosy earnings and confident quarterly calls, the firm was neck-deep in junk: subprime mortgage assets, commercial real estate gambles, and a shadow balance sheet full of toxic bets they couldn’t offload.

To mask the risk, Lehman turned to a little trick called Repo 105—an accounting sleight-of-hand that temporarily removed billions in liabilities from the books, just in time for quarterly earnings. Poof. Problem solved.

They weren’t deleveraging. They were photoshopping insolvency.